British Imagination Technologies Acquired by Malicious Chinese Actor Canyon Bridge Fund in Attempt to Gain Semiconductor IP

by Alessandro Zadro, Darren Tebbitt, and Daniel Burke

On November 17, the BBC released an article detailing the acquisition and subversion of UK semiconductor company Imagination Technologies. Through a series of offshore investment vehicles, the British company found itself owned by Chinese state-owned investment vehicle China Reform Holdings, itself answering directly to the Chinese State Council. This allowed the Chinese government to gain access to critical semiconductor manufacturing technology, leapfrog arduous R&D periods, and advance its development goals at the cost of British competitive advantages.

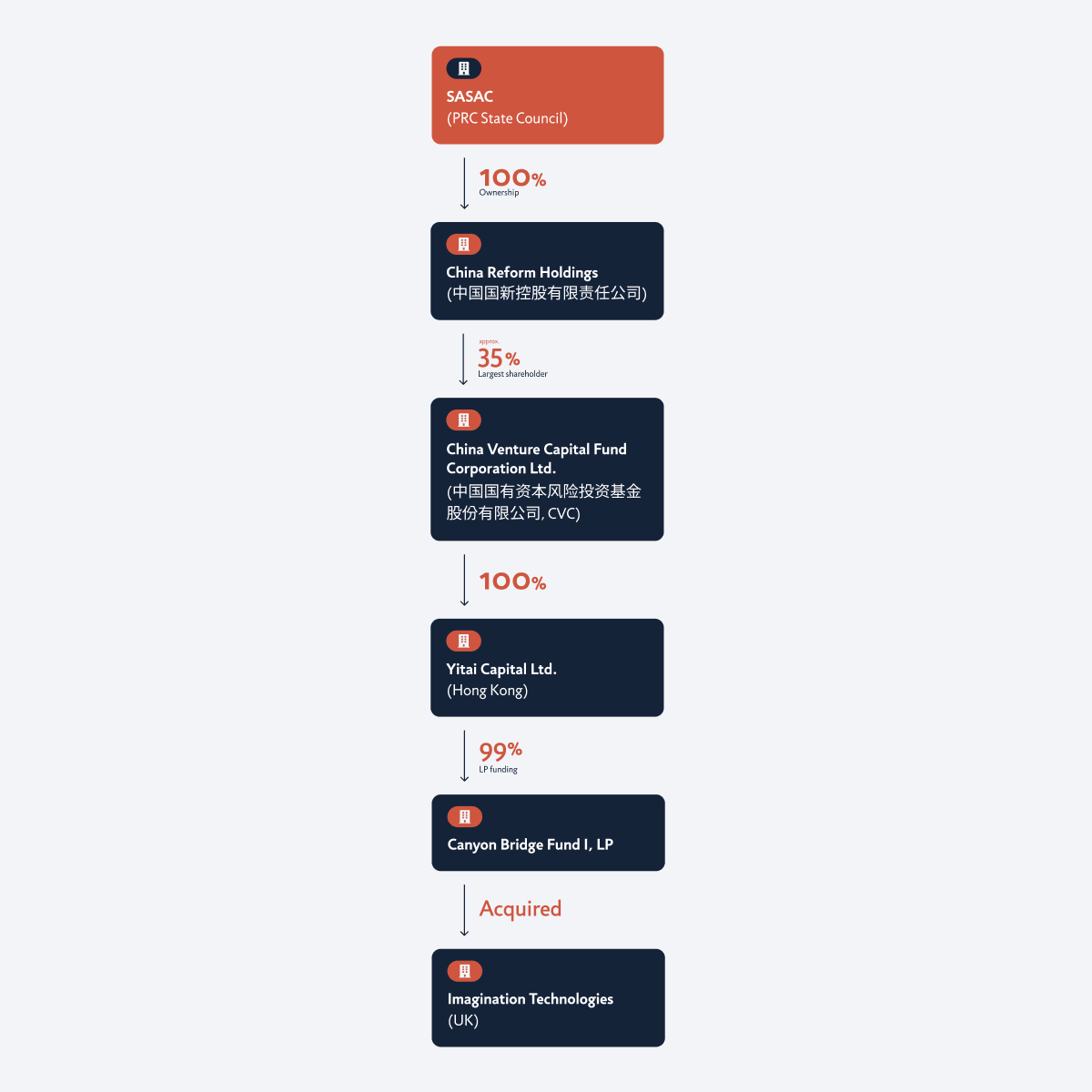

Imagination Technologies was acquired in 2017 by Canyon Bridge Fund LLP, itself four levels of direct ownership under the Chinese Government’s State-owned Assets Supervision and Administration Commission (SASAC). This example highlights the layers of obfuscation that often exist with Chinese attempts to gain key foreign technology. Rarely are entities wholly private, instead existing within a complicated web of ownership, subsidiaries, and personal connections are often lead back to the Chinese Government. Since at least 2015, these obscured organizations have been aggressively pursuing foreign technology and trade secrets to bring back to China.

The Chinese government considers semiconductor manufacturing and development to be a goal with the utmost importance. Semiconductors are used in every type of electronics. From washing machines to F-35s, semiconductors are the lifeblood of modern society and the economic activity that drives it. As some early reports out of the Ukraine war highlight, semiconductor shortages can drive an army to its knees just as quickly as a lack of food supplies. Because of this, semiconductors have been a development goal of the highest priority for the Chinese Government, particularly through investment vehicles like the “Big Fund” and acquisition attempts conducted by organizations like Canyon Bridge.

Datenna analysed the Canyon Bridge acquisition of Imagination Technologies back in 2020, and uncovered an additional layer beyond that covered by the BBC piece. Through Datenna’s proprietary data gathering capabilities and information platform further, we are able to not only highlight the danger that Canyon Bridge displays through its connections to the PRC State Council, but can also show where Imagination Technologies’ products are mostly likely being siphoned off towards.

The full ownership chain from the PRC State Council down to Imagination Technologies is as follows:

China Venture Capital Fund Corporation Ltd. (CVC) sits between China Reform Holdings and the vehicle that ultimately acquired Imagination Technologies. Rather than investing directly, China Reform — as CVC’s largest shareholder — channels capital through this intermediary, which wholly owns Yitai Capital, the Hong Kong entity that funded Canyon Bridge’s acquisition. It adds corporate distance, but ultimate control still traces straight back to the PRC State Council via SASAC.

CVC is noteworthy due to its sprawling network of investments and subsidiaries. Its portfolio includes positions in military procurement, aerospace, advanced technologies, and at least one blacklisted entity. Due to its position under the Chinese government, these connections introduces both regulatory and geopolitical risk that CVC has the ability and political will to channel its resources towards supporting the People’s Liberation Army (PLA) growth and modernization. CVC also funnels state-backed capital into high-tech sectors — semiconductors, telecommunications, advanced manufacturing — making it a key vehicle for China’s innovation and supply-chain strategy. CVC is a key cog in the mechanisms built out by the CCP to build up China’s military and high-tech sectors at the detriment to other nations.

Looking at CVC’s parent (China Reform), its wider portfolio also reveals how Chinese state-linked capital is deployed. From just the first layer of visible ownership, the following entities all have close ties to CVC:

- China Guoxin Fund Management Co., Ltd.: wholly owned by China Reform, manages state-backed funds channelling capital into AI, quantum, aerospace and cybersecurity, shaping China’s strategic and dual-use technology ecosystem.

- China National Pharmaceutical Group Co., Ltd. (Sinopharm): a core state-owned healthcare and biopharma conglomerate central to China’s vaccine production, medical-supply chains and national drug distribution.

- COMAC: the aerospace manufacturer behind the C919 and ARJ21 jets, subject to U.S. export controls and listed as an alleged Chinese military company.

- China Tower: controls much of China’s telecom infrastructure and supports networks the PLA relies on.

- China Railway Group: a major SOE involved in Belt and Road projects and defence procurement.

These connections highlight how influence, technology and capabilities circulate through complex corporate structures to the ultimate benefit of the CCP. Further, they also emphasize the necessity of digging down on ownership structure to reveal who is benefitting from expensive overseas investments.

This is the true strength of Datenna’s platform. The information available is used to map the deeper ownership layers and the long chains of relationships between companies, research institutes, state-capital vehicles and defence actors. This gives governments and companies the visibility necessary to make proper decisions about potential investors and what entity may ultimately be sitting at the top of the chain.

Most organisations focus on a fairly narrow set of around a thousand sanctioned entities. However, Datenna tracks more than 2.7 million companies of interest across dual-use technology, defence procurement, state-capital networks and sensitive research domains. This broader view reveals the patterns sitting below the surface.

Some highlights from Datenna’s current coverage:

- 47 million companies

- 80 million associated individuals

- 4.6 million procurement records

- 45 million patents with technology classifications

- 775,000 government-funded research projects and 27,000 research institutes

- 194 million relationships across corporate, academic and government networks

This foundation allows users to follow investment paths, state influence and defence connections in a way that goes well beyond standard registry data.